Redesigned the information architecture for 15+ fragmented features, transforming them into a cohesive self-service experience across app and web, validated through usability testing.

Project overview

June 2020 – January 2021

Context

Rabobank is one of the largest banks in the Netherlands, and the largest bank world-wide in agriculture. I worked in a design team of 50 designers in total (2020). It was my responsibility as lead designer for the app, to improve the customer experience and to create new product strategies. Together with a team of 10 product designers, I shaped the use of one of their biggest channels: the service tab and the store tab. For this project I initiated a complete redesign to enable customers in self service.

• Objective: Improve the findability of card-related settings (e.g., blocking or unblocking cards) in the app, reducing call center dependency and enhancing user experience.

• Responsibility: initiated project including discovery & data analysis, and responsible for design delivery.

• Team: Cross-functional collaboration with designers (app & web), developers, and customer service teams.

• Role: Lead designer – Rabobank App

Challenges

• High volumes of customer support calls for routine actions already available in the app, such as blocking, unblocking, or replacing cards.

• Each call cost approximately €12, with the top three call reasons alone accounting for €1.2 million annually, highlighting the financial impact of poor usability. And addressing the pain point of the app users.

• Poor findability of card-related features due to hidden settings and confusing navigation, leaving users frustrated and reliant on support.

Outcome

• Significantly increased the findability of card services, validated through app analytics and user feedback.

• Reduced call center volumes for card-related issues.

• Laid the groundwork for a larger navigation redesign of the app (executed in subsequent projects).

See the live version

Discovery research

Approach - Product Led Way of working

Discovery Phase

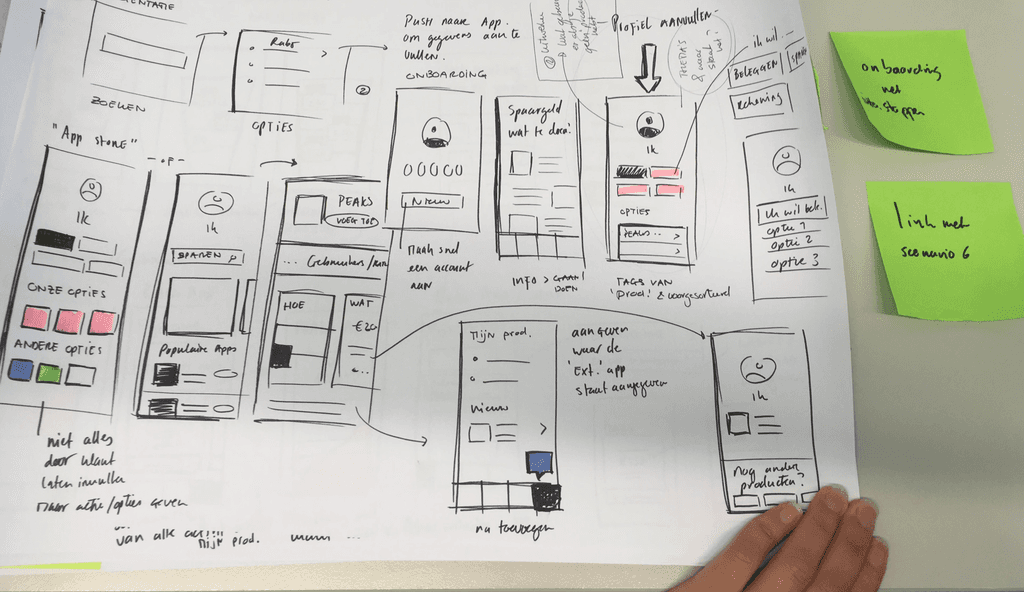

• Data Insights: Analyzed app usage data to identify user behaviors and frequently accessed card services.

• Explorative Research: Conducted user interviews to understand how customers search for help and interact with the app.

Concept & design development

• Information Architecture: Redesigned the entire information architecture for 15 features that were previously scattered without clear ownership. Streamlined these features into a cohesive experience, aligning with the Web design team to ensure cross-platform consistency.

• Prototyping and Validation: Designed solutions, iterated prototypes, and conducted six rounds of customer testing to refine usability.

Stakeholder management

• Business Case Development: Built a compelling case, demonstrating the potential to reduce call center volumes and improve customer satisfaction.

• Successfully advocated to the management team (MT) to assign a dedicated product owner to this tab.

• Collaboration: Worked closely with the DevOps team to implement changes and ensure technical feasibility.

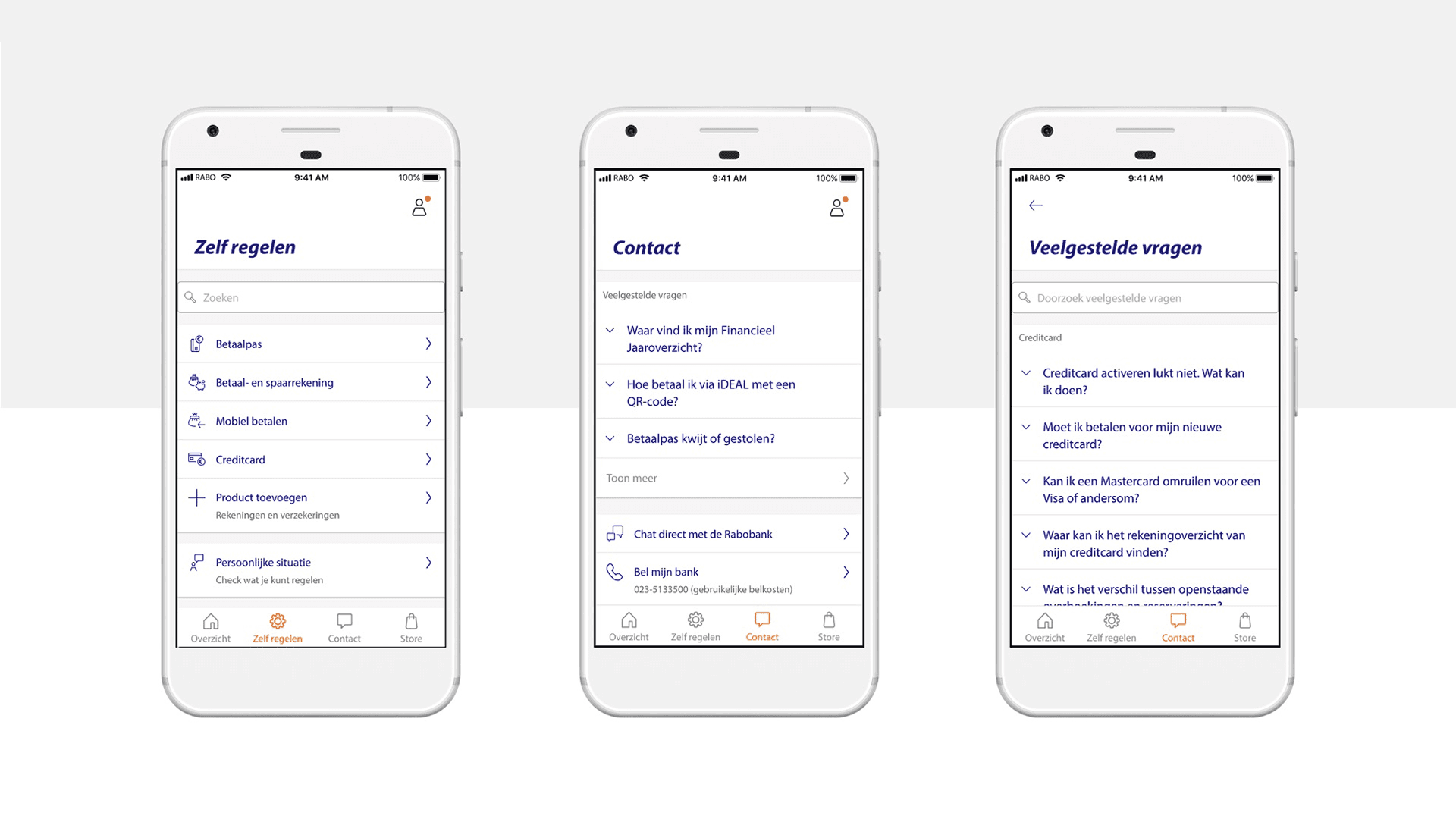

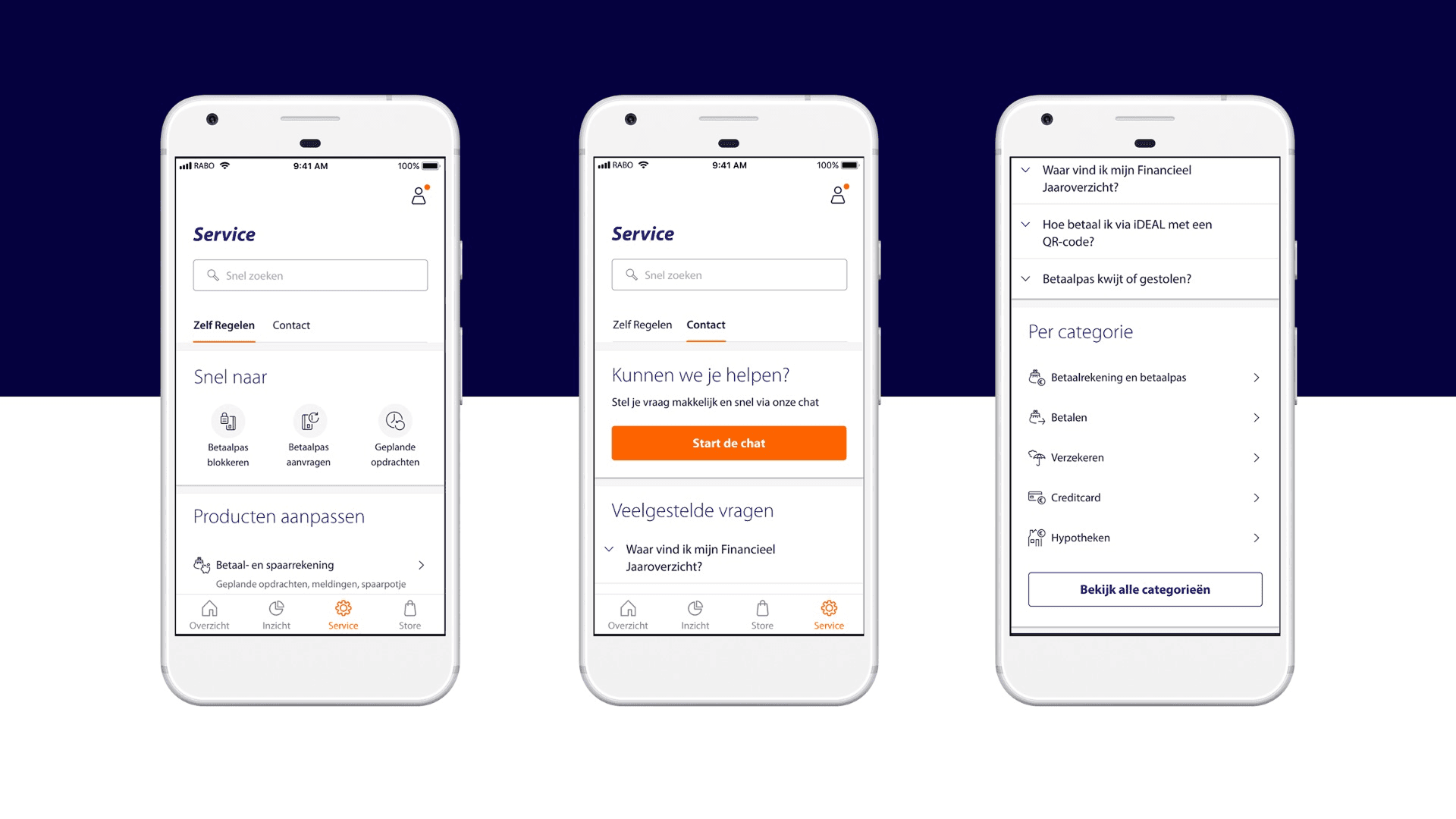

Before: Rabobank customer service (2020)

The old version had separate tabs for self-service and contact, taking up valuable screen real estate

and lacking clear ownership. I took the lead in re-evaluating both tabs by data and number of usage.

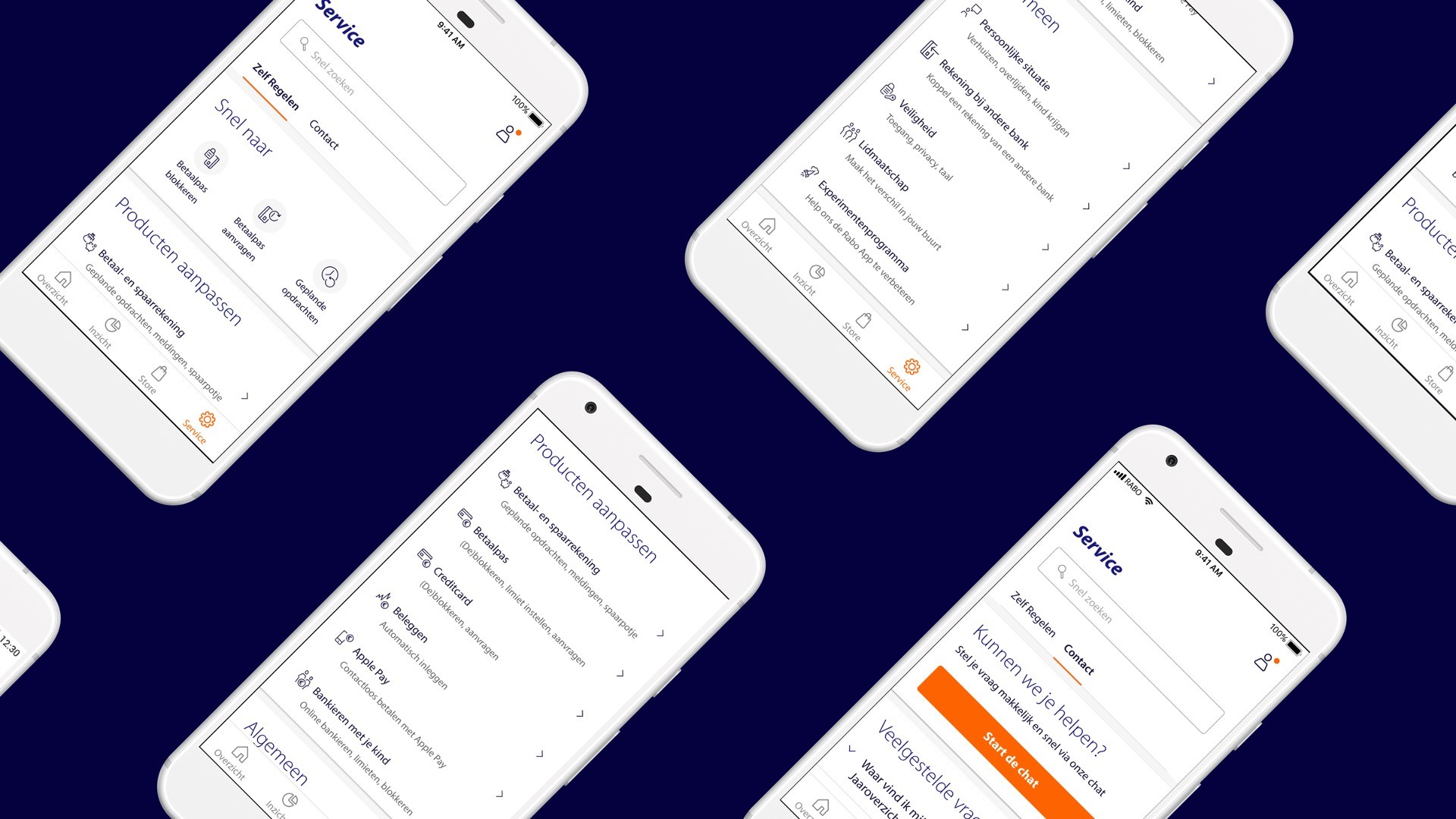

After: Redesign of the Self Service tab (2021)

The redesign combines both into a single streamlined tab focused on the top three user needs,

freeing up space for future features like "financial insights" while improving clarity and usability.

Legal

Privacy Policy

Terms of Use

Accessibility

Credits

Design: Ruddy Rodriguez

bol.com

Partners